Consumer behaviour constantly evolves, but never as rapidly as it has in the past few years. According to IWSR Drinks Market Analysis (IWSR), a global beverage alcohol data and insights specialist firm, a recession compounded with the ongoing pandemic has forced some Canadians to rethink their drinking habits.

“What we found through our research was the last two years were really a market correction after the high growth rates of alcohol consumption during the early days of the pandemic,” said Ryan Lee, a market analyst with IWSR. “Overall personal alcohol consumption is expected to remain above pre-pandemic levels into 2023, although less than those seen during the pandemic.”

Moreover, consumer habits developed during the pandemic have remained intact, even as more people venture to restaurants and bars.

“Many consumers purchased premium products during the height of the pandemic. So, it could entice them to spend more when they’re out,” said Lee. “At the same time, as the recession continues to impact Canadians’ financial situations, it could slow premiumization trends too.” Lee says the latest findings from consumer research in February 2023 show that Canadian drinkers are reducing their stated alcohol consumption and spending, though this is nuanced by specific category. “This change in behaviour has a lot to do with growing feelings of insecurity and apprehension, especially among younger adults,” he said.

IWSR insight shows that while drinking at bars and restaurants may see a decline, purchasing alcohol from liquor stores, in particular premium liquor, may remain steady or even increase. Lee says diversifying product selection can help navigate these uncertain times, but paying attention to consumer behaviour will help beverage alcohol producers focus on which brands to invest in. Here are three consumer insights to help navigate the 2023 landscape.

Any occasion to clink

While the total wine category is declining in volume, IWSR shows that sparkling wine continues to grow in Canada. “There’s a pent-up demand to celebrate weddings, holidays, gatherings and other personal milestones after the pandemic restrictions,” said Lee. “A key driver here is a change in attitude from these beverages being exclusively for formal events or special occasions. Now, people are enjoying Champagne and Prosecco in more relaxed contexts, and more frequently.”

The analysis shows strong demand from Canada’s southern neighbour, as premium and above sparkling wine grew in volume by eight per cent between 2019 and 2020 in the United States.

“People got used to working with premium products during the lockdown,” said Lee. “Higher-quality products mean higher expectations, and two effects of the pandemic on the alcohol market are expected to remain the same over the long term – higher e-commerce engagement and at-home cocktail culture – and drive spirit consumption.”

Protecting their body and wallet

Lee says health and wellness are on a lot of peoples’ minds. “In a recent IWSR survey, we discovered that around half of the adults we surveyed were more interested in moderating their alcohol consumption,” said Lee. “And younger adult consumers, like millennials and generation Z, are much more likely to moderate their drinking habits than older generations.”

Unlike the first insight, where some consumers opted for more premium beverages, others are turning to non-alcoholic ones. “Molson Coors Beverage Company, formerly Molson Coors, changed the longstanding company name to represent a shift toward a wider beverage portfolio outside of just beer,” said Lee. “The company has also invested in non-alcoholic beverage categories such as Zoa Energy, an energy drink created by a team that includes Dwayne Johnson, and VYNE, a botanical hop-infused sparkling water.”

IWSR found that beverages with no alcohol grew by nine per cent in 2022, increasing their volume share of the overall no- or low-alcohol space from 65 per cent in 2018 to 70 per cent across 10 key markets, including Canada and the U.S. “No-alcohol is growing faster than low-alcohol in most markets,” said Lee. “It has a lot to do with improved taste, production techniques and a diversification of consumption occasions.”

IWSR expects no-alcohol volumes to grow at a compound rate annually by nine per cent between 2022 and 2026 across key markets (including Canada, and the U.S.).

Spirit-based RTDs

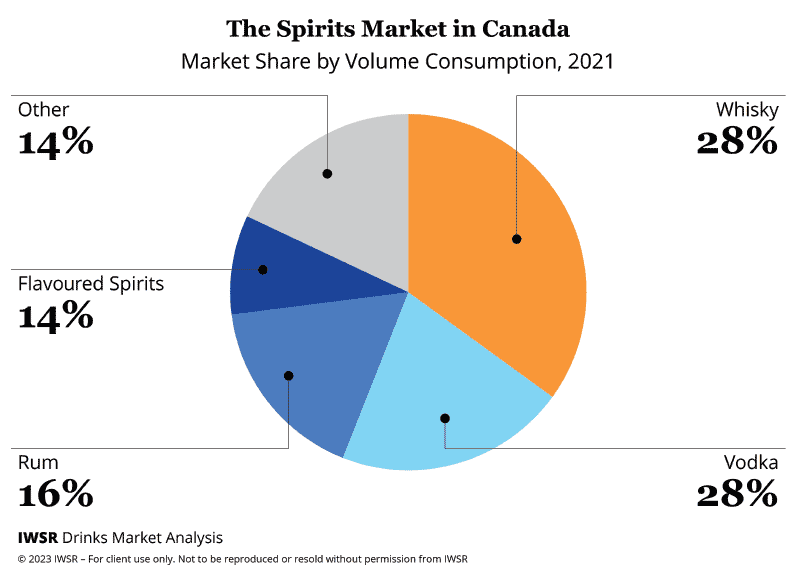

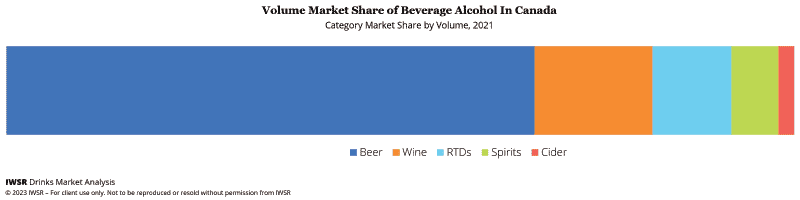

Lee says in total volume terms in 2021, every major category except ready-to-drink (RTD) across all alcohol bases posted negative growth in Canada. However, it’s not the traditional hard seltzers he’s referring to in this instance. “Premium-priced RTDs have grown faster than any other segment over the past two years,” said Lee. “On a smaller volume base, but at increasingly higher prices.”

IWSR reports that consumers in some markets trade up to RTDs from categories like beer. In some cases, consumers pay roughly double for the same serving size of RTD as beer. Findings from IWSR show that across 10 key markets, spirit-based RTDs – especially those made with vodka – held 45 per cent of the volume share of the RTD category in 2021, driving most of the beverage industry’s innovation.

“With the RTD category firmly established in markets such as the U.S., and competition at an all-time high, brand owners continue to focus on innovative products and brand extensions or partnerships to drive greater awareness and distribution. The RTD innovation IWSR is tracking year-on-year clearly shows a rapid pace of product transformation to meet consumer demand,” said Lee. “There is no single dominant type of RTD globally, which makes the category uniquely positioned to capitalize on local tastes and trends.”

Diversifying a brand

With such an extensive array of directions, Lee says it’s never been more important for companies to review their portfolio and determine where gaps exist in consumer demand and opportunity. “Many brands across beverage alcohol are diversifying their portfolio to engage and take a share in high growth categories,” said Lee. “Diversifying also allows producers to reach a wider consumer demographic and maintain a portfolio to meet evolving consumer demands.”

Even traditional, non-alcoholic brands are moving into the market. “The Coca-Cola Company launched Topo Chico hard seltzer in partnership with Molson,” said Lee. “But the company’s first alcoholic product was a chuhai, which is a type of RTD called Lemon-Dou, that launched in Japan in 2018.”

One thing to remember, says Lee, is that companies are no longer selling products to groups of consumers. “Companies are now selling products that fit a variety of consumer occasions,” he said.